How to Win Chargeback Disputes: A Comprehensive Guide for Businesses

Author :- TickleCharge June 2, 2023, 8:05 a.m.

Chargeback disputes can be a nightmare for businesses, especially those in high-risk industries like iGaming and adult entertainment. These are detrimental to businesses in every possible way – leading to loss of revenue, damage to reputation, and potential fees from banks and payment processors. In this article, we’ll explore how high-risk businesses such as iGaming and the adult entertainment verticals can win chargeback disputes and protect their bottom line.

According to industry data, the iGaming and adult entertainment industries have some of the highest chargeback rates, with chargebacks accounting for up to 10% of all transactions. This is attributed to a variety of factors, including fraud, identity theft, and customer dissatisfaction.

But there is no one-size-fits-all solution for all kinds of chargeback disputes. According to experts at TickleCharge, real solutions vary because they are based on the type of fraud that is responsible for the dispute.

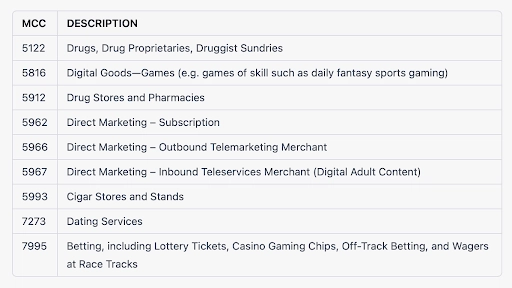

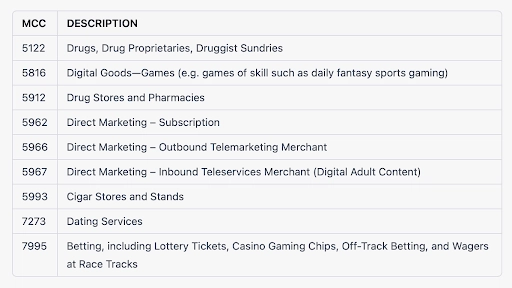

Visa defines a ‘high-brand risk merchant’ as a merchant outlet accepting or sending card-absent (and in some cases specifically cross-border) payments, required to be classified with one of the following Merchant Category Codes (MCC):

High-risk merchants, such as adult and online gaming businesses, need to factor in the risk of chargebacks in their business models and choose a payment partner who specializes in dealing with high-risk businesses.

Visa and Mastercard have both introduced new chargeback guidelines that allow merchants to dispute chargebacks before they become final. These include representment, which enables merchants to provide evidence and documents to support their case. Merchants can also take advantage of chargeback alerts, which notify them when a customer disputes a charge, giving them an opportunity to resolve the issue before it escalates.

Here’s a quick synopsis of these guidelines:

- Pre-Arbitration: Merchants can submit evidence to their payment processor to dispute a chargeback before it becomes a full chargeback. This process is called pre-arbitration and can help merchants avoid the cost and hassle of a full chargeback.

- Reason Code Clarity: Visa and Mastercard have clarified their reason codes for chargebacks, making it easier for merchants to understand why a chargeback was initiated and how to dispute it.

- Collaboration: Visa and Mastercard are working with payment processors and merchants to improve dispute management and reduce the number of chargebacks.

Recommended Strategies to Prevent and Win Chargeback Disputes:

- Do not skimp on Customer Service: Providing excellent customer service can prevent chargeback disputes. According to a study by Salesforce, 77% of customers will recommend a company after a positive customer experience, reducing the likelihood of chargebacks.

Additionally, a study by PayPal found that businesses with easy and transparent return policies have lower chargeback rates. For example, an online casino may offer live chat support to quickly address customer concerns and resolve issues. Similarly, an adult website may offer a dedicated support team to address customer inquiries and complaints.

- Respond Quickly and Effectively: One of the most critical steps in winning chargeback disputes is to respond quickly and effectively. The card issuer typically gives merchants a limited amount of time (about 30 days) to respond to a chargeback notification, so it is important to act quickly.

Failing to respond in a timely manner can result in a default judgment in favor of the customer.

- Invest in Evidence Collection Practices: Evidence collection is crucial in winning chargeback disputes. According to a study by ACI Worldwide, businesses that provide compelling evidence win 40% of disputes. Keeping detailed records of transactions, including customer information, purchase details, and shipping information, can help provide compelling evidence.

When responding to a chargeback dispute, businesses must provide as much evidence as possible to support their case. This can include documentation of the transaction, customer communications, and evidence of delivery or completion of the service. Providing comprehensive evidence can increase the chances of winning the dispute.

For example, an online casino may provide evidence of the customer’s gameplay history, showing that they voluntarily participated in the games and acknowledged the terms and conditions. Similarly, an adult website may provide evidence of the customer’s login and usage history, demonstrating that the customer had full access to the site and its content.

- Keep Processes Ready to Dispute Chargebacks: Disputing chargebacks is critical in winning disputes. According to a study by Verifi, businesses that dispute chargebacks win 59% of disputes. Responding to chargeback disputes within the given time frame is crucial to avoid losing the dispute by default.

- Work with Right Payment Solution Partners: Working with payment solutions is essential in preventing and winning chargeback disputes. Payment solutions can provide businesses with tools and resources to prevent and dispute chargebacks. A study by the Electronic Transactions Association found that businesses that work with payment processors that specialize in chargeback prevention and management have lower chargeback rates.

Conclusion

Chargeback disputes can harm businesses, but with effective strategies in place, businesses can prevent and win disputes.

Real high-risk industry merchants who have successfully managed chargeback disputes include online gaming companies like Playtech and the adult industry company, Adam & Eve. These companies have implemented chargeback prevention strategies that have enabled them to win disputes and protect their business profits and reputation.

Providing excellent customer service, evidence collection, disputing chargebacks, and working with payment solutions are essential steps backed by published research in the payments and chargeback industries. High-risk merchants need to factor in the risk of chargebacks in their business models and choose payment solutions that specialize in dealing with high-risk businesses. By taking these steps, businesses can protect their revenue and reputation.

FAQs

What is a chargeback?

A chargeback is a dispute initiated by a customer with their bank or card issuer to reverse a transaction. The bank or card issuer investigates the dispute and may issue a provisional credit to the customer while the investigation is ongoing.

Why are high-risk merchants more susceptible to chargebacks?

High-risk merchants, such as those in the adult entertainment, sexual wellness, and online gaming industries, are more susceptible to chargebacks due to higher rates of fraud and disputes.

What is chargeback representment?

Chargeback representment is a process in which merchants can dispute a chargeback by providing additional evidence to their payment processor to support their case.

How can merchants mitigate chargebacks?

Merchants can mitigate chargebacks by improving customer service, using fraud prevention tools, monitoring chargeback ratios, and keeping accurate records.

What are the new Visa and Mastercard chargeback guidelines?

The new Visa and Mastercard chargeback guidelines include pre-arbitration, reason code clarity, and collaboration between payment processors and merchants to improve dispute management and reduce the number of chargebacks.

TALK TO US

INQUIRE NOW